In an era where cyber threats are evolving at an unprecedented pace, security operations center (SOC) teams face mounting pressures to manage increasing alert volumes effectively. Recognizing this challenge, CrowdStrike has introduced a groundbreaking solution: Charlotte AI Detection Triage. This innovative platform automates alert assessment with remarkable accuracy, significantly reducing the manual workload on SOC teams and reclaiming over 40 hours of resources each week. As security experts emphasize the need for advanced tools to combat sophisticated adversaries, Charlotte AI stands at the forefront, empowering defenders to stay ahead in the relentless battle against cybercrime.

| Feature | Description | Benefits |

|---|---|---|

| Charlotte AI Detection Triage | Automates alert assessment with over 98% accuracy. | Reduces manual triage by more than 40 hours per week. |

Understanding Charlotte AI Detection Triage

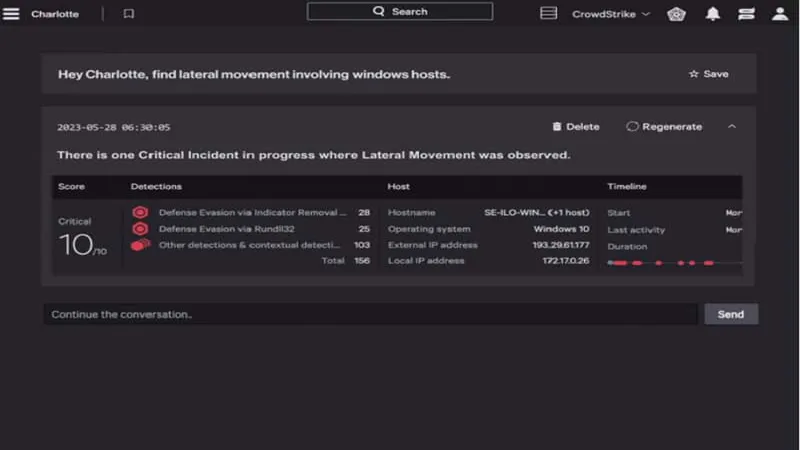

Charlotte AI Detection Triage is an advanced tool developed by CrowdStrike to help security operations centers (SOCs) manage alerts more efficiently. With a remarkable accuracy rate of over 98%, this AI system automates the alert assessment process. This means that instead of spending hours sorting through alerts, SOC teams can rely on Charlotte to identify the most important threats quickly, saving valuable time and reducing stress.

By automating the triage process, Charlotte AI allows security analysts to focus on more serious threats rather than getting bogged down by false alarms. This not only helps in responding to real incidents faster but also allows teams to maintain a high level of accuracy. The integration of Charlotte AI into existing security workflows ensures that it continuously learns and adapts to new threats, making it a powerful ally in the fight against cyber attacks.

The Importance of Automation in Cybersecurity

Automation plays a crucial role in modern cybersecurity, especially as the volume of alerts grows daily. Security teams often face overwhelming amounts of data, making it challenging to prioritize threats. By using automated systems like Charlotte AI, organizations can streamline their operations and quickly identify which alerts require immediate attention, thus enhancing their overall security posture.

Moreover, automation reduces the risk of human error, which can lead to missed threats or delayed responses. With Charlotte AI filtering out low-risk alerts, analysts can concentrate their efforts on high-impact incidents, ensuring that resources are used efficiently. This not only improves incident response times but also helps prevent potential security breaches.

Enhancing SOC Efficiency with AI

CrowdStrike’s Charlotte AI Detection Triage empowers security operations centers (SOCs) to operate at unprecedented efficiency. By processing millions of triage decisions monthly, this tool provides valuable insights that assist analysts in making informed decisions quickly. The ability to automate alert assessments allows SOC teams to reduce the time spent on manual tasks and focus on understanding and mitigating real threats.

Additionally, Charlotte AI’s integration with Falcon Fusion enhances the automation process, allowing for quicker responses to identified threats. This collaboration between different AI systems enables a more holistic approach to cybersecurity, where teams can respond to incidents in real-time, ultimately leading to a more secure environment for organizations.

The Multi-AI Architecture Advantage

CrowdStrike’s innovative approach, known as the multi-AI architecture, is designed to tackle the complex challenges faced by security operations centers. By deploying specialized AI agents, or ‘droids,’ each with unique capabilities, organizations can manage alerts and respond to incidents more effectively. This collaborative AI system enhances threat detection and reduces the burden on human analysts.

Each AI agent in this architecture is tailored for specific tasks, optimizing workflows within SOCs. This means that instead of relying on a single AI solution, organizations can leverage the strengths of multiple agents working together. This not only increases accuracy in threat detection but also ensures that the SOC teams can focus on strategic decision-making rather than getting overwhelmed by alerts.

The Role of Generative AI in Cybersecurity

Generative AI is becoming increasingly important in cybersecurity, especially as organizations seek to enhance their defenses against sophisticated cyber threats. According to a recent survey, a significant majority of cybersecurity professionals prefer generative AI tools that are integrated into dedicated security platforms. This integration allows for more effective threat detection and response capabilities.

Moreover, generative AI is specifically designed to address the unique challenges of cybersecurity, providing tailored solutions that enhance the overall security posture of organizations. By focusing on measurable outcomes, such as faster response times and improved decision-making, generative AI is proving to be a vital component in the evolving landscape of cybersecurity.

Responsible AI Adoption in Security

As organizations increasingly adopt AI technologies for cybersecurity, responsible implementation becomes crucial. CrowdStrike emphasizes the concept of ‘bounded autonomy,’ which allows organizations to control the level of authority AI has in triage and response processes. This flexibility is essential for managing potential risks associated with AI use.

Security leaders are encouraged to establish clear policies governing AI adoption, addressing concerns such as data exposure and adversarial attacks. By ensuring that AI systems operate within well-defined parameters, organizations can harness the benefits of automation while maintaining the necessary safeguards to protect their assets.

Frequently Asked Questions

What is Charlotte AI Detection Triage?

Charlotte AI Detection Triage is a system by CrowdStrike that automates alert assessments with over 98% accuracy, significantly reducing manual work for security operations teams.

How does Charlotte AI improve efficiency in SOCs?

It automates triage processes, filtering out false alerts and allowing security analysts to focus on real threats, thus enhancing response speed and reducing alert fatigue.

What are the main features of Charlotte AI?

Key features include autonomous triage, low-risk alert closure, and integration with Falcon Fusion for streamlined detection and automated response workflows.

Why is accuracy important in threat detection?

High accuracy in threat detection, like the 98% achieved by Charlotte AI, helps prevent security teams from being overwhelmed by false positives, allowing them to focus on true threats.

How does CrowdStrike ensure continuous improvement of Charlotte AI?

Charlotte AI learns continuously from millions of expert-labeled triage decisions, adapting to new attack techniques in real-time to maintain high accuracy.

What does ‘bounded autonomy’ mean in AI security?

‘Bounded autonomy’ allows organizations to control AI’s decision-making authority in triage and response, balancing efficiency with oversight based on their risk tolerance.

Why do security teams prefer integrated AI solutions?

Integrated AI solutions help security teams respond faster and more efficiently, providing measurable outcomes, which is crucial for improving overall cybersecurity operations.

Summary

CrowdStrike has introduced Charlotte AI Detection Triage, a new tool designed to help security teams handle alerts more efficiently. By automating the assessment of security alerts with over 98% accuracy, it reduces manual work by more than 40 hours each week. This innovation allows analysts to focus on real threats while filtering out false alarms. The system learns continuously from real-world data, adapting to new attack methods. Additionally, it uses a multi-AI approach to enhance security operations, ensuring that teams can respond quickly to emerging threats while maintaining control over automation.