In the dynamic landscape of the financial services industry, where regulatory challenges and data management are paramount, the integration of artificial intelligence is becoming increasingly crucial. Leading the charge, BNY Mellon, an investment and custodial bank with a storied past, is revolutionizing its operations through the development of sophisticated AI agents. These innovations aim to streamline communication and enhance client engagement, particularly for their sales teams. As financial institutions cautiously embrace generative AI amidst regulatory uncertainties, BNY’s pioneering efforts with its AI tool, Eliza, exemplify a transformative approach to leveraging technology for improved service delivery and operational efficiency.

| Category | Details |

|---|---|

| Industry Overview | The financial services industry is highly regulated and manages large amounts of data. |

| Generative AI Integration | Financial companies are cautiously integrating generative AI and AI agents into their services. |

| BNY’s AI Tool | BNY is modernizing its AI tool, Eliza, to be a multi-agent resource that aids sales representatives. |

| Agent Functionality | Agents help sales teams by providing product knowledge and recommendations to clients. |

| Multi-Agent Architecture | BNY uses a multi-agent system to connect different units and streamline information access. |

| Client Interaction | Agents reduce the number of interactions needed for sales teams to provide recommendations. |

| Eliza Tool Features | Eliza has around 13 agents that work together to recommend products based on client segments. |

| Development Process | BNY collaborated with various departments and used open-source solutions like Microsoft’s Autogen. |

| Future of Eliza | BNY plans to enhance Eliza to offer more intelligent services and actionable insights. |

| Next Version Goals | Eliza 2.0 aims to improve learning, reasoning, and provide better risk management and transparency. |

Understanding Financial Services and AI

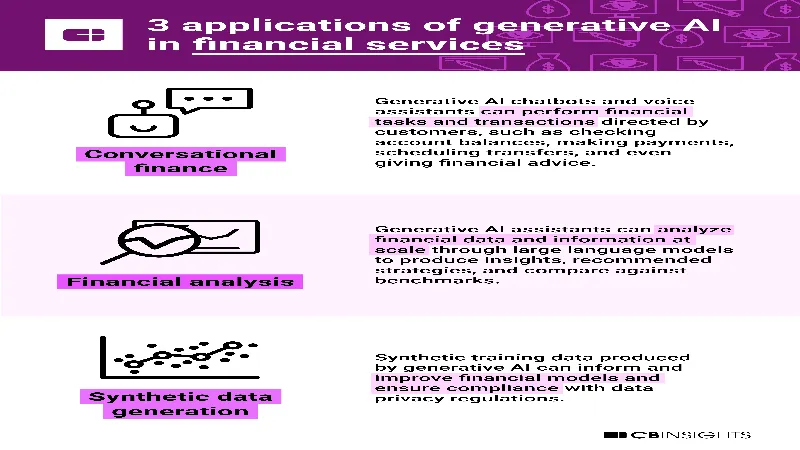

The financial services industry is a crucial part of our economy, dealing with money, investments, and banking. It is also one of the most regulated sectors, meaning there are many rules and laws to follow to keep everything safe and secure. Recently, companies in this industry have started using advanced technology, like generative AI, to help them work better and faster. This technology can assist banks and financial institutions in managing large amounts of data more efficiently.

Using AI in finance can make banking easier for customers. For instance, AI agents can help answer questions quickly and provide personalized advice. Although many companies are excited about these new tools, they are also careful because they want to ensure they are following all the rules. This cautious approach is essential, especially since the use of AI is still new in finance, and there is a lot to learn about its potential benefits.

Frequently Asked Questions

What is generative AI in the financial services industry?

Generative AI refers to advanced artificial intelligence systems that create content or data. In finance, it’s used to enhance services and improve customer interactions.

How are banks using AI agents today?

Banks like JP Morgan and Bank of America are using AI agents to assist sales teams and improve customer engagement, making recommendations easier and more efficient.

What is BNY’s Eliza tool?

Eliza is BNY’s AI tool designed to support employees by providing access to information and product recommendations using a multi-agent approach.

What benefits do AI agents offer to sales teams?

AI agents help sales teams by streamlining communication and providing quick, accurate recommendations, reducing the need to consult multiple managers.

How does BNY ensure its AI agents provide accurate information?

BNY uses Microsoft’s Autogen and collaborates with engineers to create a structured framework, minimizing errors and enhancing the agents’ reasoning capabilities.

What is the future of BNY’s Eliza tool?

BNY plans to expand Eliza’s capabilities, aiming for the next version, Eliza 2.0, to be more intelligent and capable of providing actionable insights.

Why is the financial industry cautious about using AI?

The financial industry is cautious due to strict regulations and the need for reliable systems. Companies like BNY are gradually integrating AI while ensuring safety and compliance.

Summary

The financial services industry is heavily regulated and manages vast data. Recently, companies like JP Morgan and Bank of America have started using generative AI to improve services. BNY, a historic bank, is modernizing its AI tool, Eliza, to help sales teams make better recommendations. They use a multi-agent system where agents share information about clients and bank products, reducing the number of people sales staff need to contact. BNY aims to enhance Eliza’s capabilities further, focusing on learning, reasoning, and providing valuable insights to meet client needs.